will my credit score go up if i finance a car

Each credit report the auto loan lender pull adds 1 new hard inquiry and each. But if paying off a car loan decreases your average account age.

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

New Credit Scores Take Effect Immediately.

. Now thats not to say that applying for car finance will. The additional inquiries for the car loans could ding your score -- although multiple inquiries for auto loans in a 30-day period are counted as one for your score generation. Generally speaking when you pay off a car loan or lease your credit score will take a mild hit.

Because a portion of your credit score is derived from credit mix getting a car loan may help your credit profile if you dont already have an installment loan. If interest rates have increased since you took out your original car loan it may be impossible to get a better financing rate even if your credit scores have also improved in the. Credit scores take into account your current.

In general a longer credit history will increase your FICO Scores. Ad Access Your Credit Report and FICO Score Daily. How applying for a new auto loan will impact your credit score.

There are five factors that. When you visit a dealer and decide to purchase a car fill out the loan paperwork and give the dealer permission. Free Credit Monitoring and Alerts Included.

Your credit score is a number between 300 and 850 on the FICO scale which is the most commonly used credit scoring model used by auto lenders. 495 53 votes Once you pay off a car loan you may actually see a small drop in your credit score. While soft checks do not show on or have an impact on your credit score a full credit check that a lender carries out when you apply will.

View Your Credit Report and FICO Score. Your score in general will not be drastically changed. Learn about our Rate Beat and Loan Experience Guarantee Now.

The short answer. When you pay off your auto loan you no longer have monthly payments and you dont owe anything else. Patience is a virtue and thats just what youll need to see your credit score improve from a car loan.

Get Expert Help With Your Credit Score. Although it seems counterintuitive paying off your car loan can actually drop your credit score temporarily for a variety of reasons. Compare Apply Today.

Ad Get Pre-Approved To See Your Real Terms For Every Vehicle. Ad You Can Increase your FICO Score for Free. Pre-qualified Shoppers See Real Terms And Actual Monthly Payments For Every Vehicle.

Your score dropped after buying a car due to hard inquiries. At the very beginning when you apply for a loan you will likely see a temporary dip in your credit score due to the hard inquiry that is applied when checking to see if you qualify. Ad Get Pre-Approved To See Your Real Terms For Every Vehicle.

How much will my credit drop after buying a car. Suddenly that makes for a less balanced healthy credit mix -- and so your credit score might take a hit once your car loan goes away. Most of us 84 rely on financing when purchasing a vehicle according to data from Experian Automotive fourth quarter 2014 and the average loan amount for a new.

It generally takes around 12 months for a new car loan or any other new credit account to appear on your credit report for the first time. In a nutshell the FICO credit scoring formula the most. To be clear your score should only go.

Ad Get Instantly Matched With The Ideal Auto Finance Option. Ad 2021s Best Credit Repair Companies. No Credit Card Required.

Ad Rates with AutoPay. Around 50 points at worst. Once you pay off a car loan you may actually see a small drop in your credit score.

For example if paying off a car loan bumps your average account age from four to six it could boost your score. However its normally temporary if your credit history is in decent. As a result the amount you owe will reflect as 0 which could lower.

However even people who havent been using credit for long may have high FICO Scores. However the lender can continue to charge interest and report the loan as paid late. When you apply for car loans your score actually drops five to 10.

Pre-qualified Shoppers See Real Terms And Actual Monthly Payments For Every Vehicle. Length of Credit History. Answer 1 of 5.

If you currently have only revolving credit accounts credit cards for instance adding installment credit in the form of an auto loan could help boost your credit score. However its normally temporary if your credit history is in decent shape it bounces back. This is because most creditors.

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Money Management Advice

Does Financing A Car Build Credit

What Is Considered Bad Credit Legacy Auto Credit

What Credit Score Is Needed To Buy A Car Lendingtree

Credit Score Range What Is The Credit Score Range In Canada

6 Best Places To Get A Free Credit Score Check Dollarsprout Credit Score Free Credit Score Check Check Your Credit Score

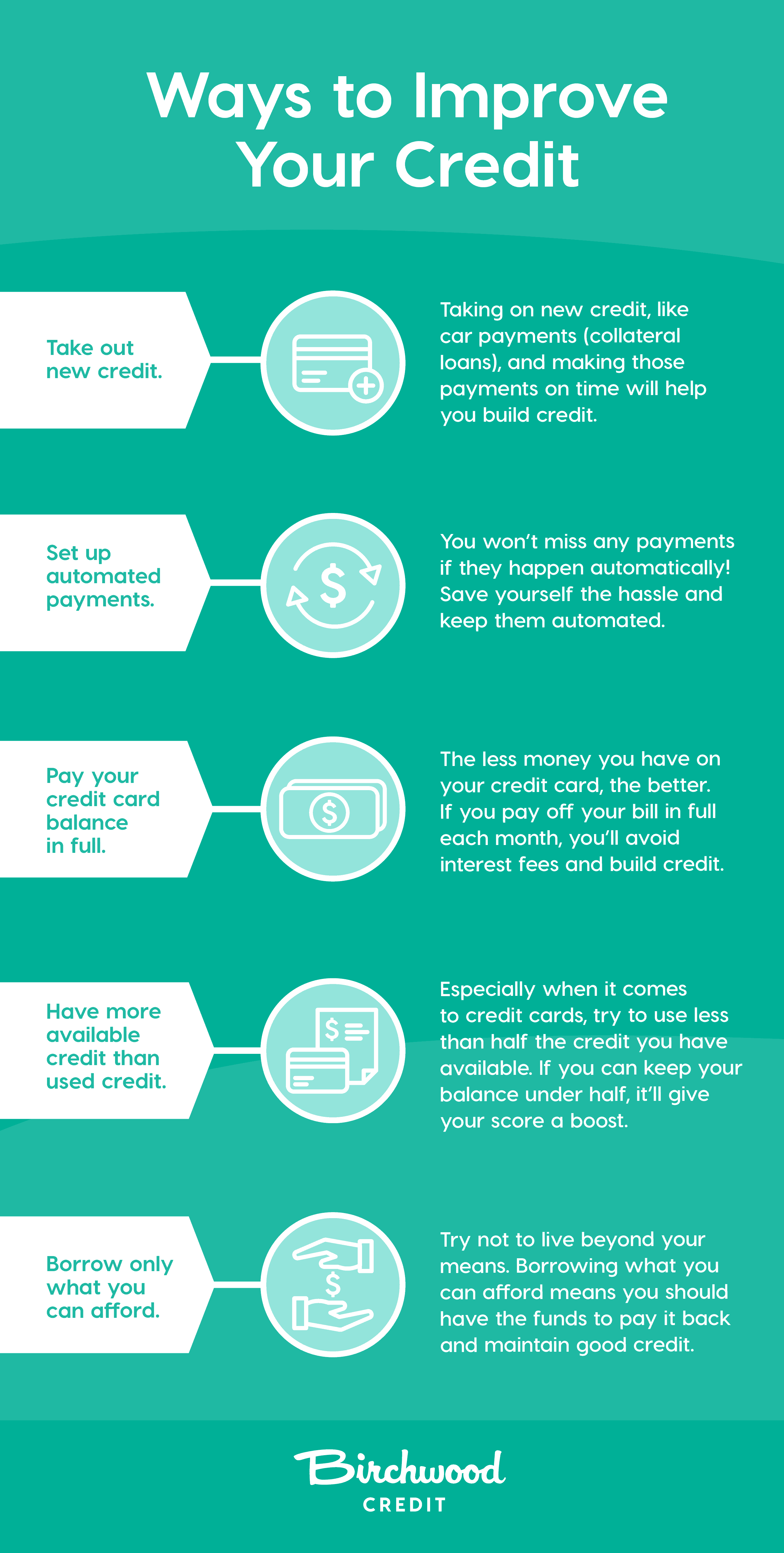

Not Available Improve Credit Credit Score Improve Your Credit Score

Raise Credit Score Quickly Credit Score Improve Credit Score Paying Off Credit Cards

What Credit Score Is Needed To Buy A Car Credit Score Car Buying Scores

What Credit Score Do You Need To Get A Car Loan

What Makes Your Credit Score Go Up And Down Credit Score Fix Your Credit Credit Repair

Getting Approved For A Car Loan Is Tough With Bad Credit Or No Credit History Here Are Some Ways To Get A Car Loan W Car Loans Bad Credit Loans For

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Credit Score

Auto Credit Loans Can Be Approved Without A Co Signer And Credit Rating Making Handsome Initial Payment Opting For Used No Credit Loans Loan Lending Company